We often associate “interest” with the “interest rate” charged on credit cards. It’s kind of a negative thing.

But instead of an annual percentage rate (or “APR”), savings accounts come with an annual percentage yield (or “APY”), which refers to the interest you earn back on deposits you put into your savings account. That means you aren’t paying the interest rate. You’re getting the interest rate back.

Did you know 69% of adult Americans have less than $1,000 in a savings account? That’s kind of a scary thought when you consider what savings are typically used for, like emergencies and how much they cost.

That’s why it’s essential that you start saving today. Earning interest increases the amount in your savings account too. Let’s look at some terms you’ll encounter when you begin looking to open a savings account.

What is interest?

Interest is what you earn from a bank or other financial institution when you deposit your money with them. They’ll use the money while you have it deposited, lending it to others. The interest they pay you is like the fee they’re paying you to lend your money to others.

Interest is calculated by a percentage, determined annually, and applied to your monthly account balance.

In a personal savings account, your deposit will earn money in the form of interest.

What is compound interest?

We know what interest is, but what about compound interest?

Compound interest is interest you earn on your initial deposit, any additional deposits you’ve made after that, and any interest you have earned on your deposits. As the interest you earn each month is retained in your account, your balance goes up, so the amount of interest you’ll earn will go up accordingly. Soon enough, you’re earning interest on your previous interest payments as much as your deposits.

Compound interest increases as your previous interest increases. This means you earn interest on interest.

If you’re wondering what kinds of savings accounts there are, and which pay the most, we’ve compiled a quick list below.

What kinds of savings accounts pay the most interest?

There are three main types of savings accounts offered by banks. Here they are:

1. Regular savings account: earns 0.01 - 2% interest and offers easy withdrawals. A regular savings account is your most standard account.

2. High-yield savings account: If you are interested in earning more interest on your deposits, consider a high-yield savings account. More fees might be applied, but most still offer easy withdrawals.

3. Money market account: earns 0.01 - 1.5% interest and can double as a checking account. This may come with access to checks and a card to use for purchases. It alleviates any transfer time or transfer fees to a checking account.

4. Certificate of deposit, or CD: has the highest interest rate among savings accounts, ranging from 0.5 - 2.5%, but the most limited access to funds. You may also have to deposit more to start up your CD. You’ll also be expected to store your deposit for some time, from six months to five years.

There are exceptions to every rule. Read the account agreement statements and call your bank up to ensure you’re getting what you think you are when you sign up for your new personal savings account.

You may consider other factors, like how your savings account can help you get into the habit of saving, and not how much it can earn for you.

Why is saving important?

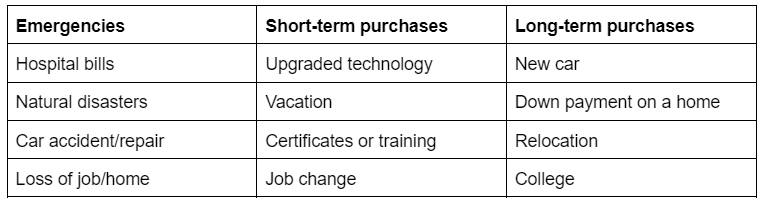

Roughly 71% of people in the U.S. have a savings account of some sort. Check out the table below and ask yourself: could I afford to pay for that? If the answer is no, you need to start saving.

Remember, if you can’t cover these costs with the balance in your checking account, start building your savings today. Things happen that are entirely out of our control. Prepare with ample sample so you can weather the blow.

Start with an emergency fund. Most experts recommend saving 3 to 6 months of living expenses in a fund for emergencies.

How to set saving goals

Figure out what you need to save for. If you don’t have an emergency savings account, that should be your #1 priority. Once you have 3 to 6 months of your income saved, that’s when you should begin to save for long or short-term goals.

To set your own savings goals, have a plan in mind. Figure out what type of savings account is best for you. A money market account may not be good if you tend to spend money irrationally and need quick access.

Then, figure out how much you can afford to save each month. 20% of your paycheck is a typical amount.

Why most people don’t meet their savings goals

It may seem easy to save, but it’s extremely challenging for some people. But why is that?

Many of us don’t know where to save or how to start saving, and a lot of us just don’t have enough money to save.

But there are also many other reasons people don’t meet their savings goals:

- Health. Some people have health issues or are supporting family members struggling with health issues. Medical bills can be expensive and can linger for many years. And mental health is a big culprit, with money often misused as part of that behavior.

- Large or high-interest debt. A lot of people assume they can't save until their student loans or high-interest credit cards are paid off. But snowball or avalanche debt pay down methods can help almost anybody pay off debts faster – and still leave room to build savings.

- Priorities. Some people do not prioritize saving. Maybe their friends don’t, and they don’t want to be “weird” by having a savings account. So instead, they go for instant gratification. Ask yourself: what’s more important to you? A lifetime of financial relief or financial stress?

Conclusion

Interest is what you earn when you deposit your money in a savings account. When you leave your interest to grow, you’ll earn even more in compound interest. Learn about the savings account that best suits your needs, and if you haven’t started yet, building your savings should be your #1 priority, so you’re prepared for emergencies and other unexpected expenses.